1. New BTC All-Time highs

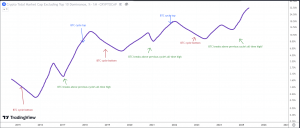

The classic 4-year cycle predicts Bitcoin will make a new all-time high at the end of 2024.

Some people are expecting it could happen earlier, perhaps even the first half of the year, and I agree; a lot of macroeconomic indicators are suggesting that. With Gold currently testing all-time highs and set to break higher, and the Nasdaq and global stocks already at all-time highs, there’s no reason for Bitcoin not to catch up shortly.

Bitcoin since 2016, log scale.

The counterargument is that there could be a recession or slowdown, which will pull most assets back down. A recession would certainly cause a short-term drawdown, but would probably also require more economic stimulus which would actually push crypto up on a longer term timeframe.

In terms of macroeconomic risks, questions still remain over long-term inflation, and risks of war spreading. Another curveball could be the SEC; who will probably approve a BTC ETF – they almost have to after Grayscale won a lawsuit against them. However, they’re under no such obligation regarding an ETH ETF. Given their current path of ‘regulation by deterrence’, I find it more likely than others that they could deny an ETH ETF. I definitely don’t think they’re going to enjoy being forced to approve a BTC ETF, and I think they’re going to do *something* to make sure they don’t seem to be softening on crypto. Maybe they could also pair a BTC ETF approval with other legal action against the crypto industry, or simply drag everything out for as long as possible while we all wait for proper regulations. Or maybe they’ll make a lot of noise with their lawsuit against Binance; CZ going to jail for a long time would certainly act as a deterrence. Whatever happens, I see curveballs ahead based on their track record, but short-term curveballs don’t change long-term trends.

2. ETH/BTC bottom

Ethereum usually lags Bitcoin; Bitcoin leads the way. I think this is a macroeconomic phenomenon; Bitcoin is more sensitive to liquidity than economic growth (as it’s a store of value more similar to gold), and Ethereum is more sensitive to growth than liquidity (as it’s a productive asset more like a stock). Greater liquidity causes growth, but with a delay, hence why ‘Bitcoin leads the way’.

It has already been leading the way as the market prices in further expected liquidity, and it has outperformed Ethereum over 2023.

We are now around the time of the cycle when ETH/BTC usually bottoms and Ethereum starts to outperform, although it’s probably premature to declare that it can’t go lower. Previous cycles have seen ETH/BTC bottom around a year after the BTC/USD bottom.

ETH/BTC since 2016. The green periods are BTC bull markets, and coincide with ETH/BTC going up. The dark red are BTC bear markets, and the pale red are the sideways post-bear markets, where ETH/BTC typically performs badly.

A simplification of the previous chart.

A simplification of the previous chart.

I expect a modest appreciation in ETH relative to BTC, congruent with previous cycles.

Once BTC has hit an ATH, ETH/BTC is free to explode. As someone with 80% of my holdings in ETH, I fully expect ETH to flip BTC about 6-12 months after that, although I will concede that I am hugely biased on that front.

Either way, history suggests 2024 will be positive for ETH/BTC.

3. Altcoins: up, down, up

This chart shows the outperformance (or underperformance) of altcoins, excluding the top 10 largest cryptocurrencies.

How altcoins perform relative to the top 10 cryptocurrencies. I’ve labelled points where BTC makes a cycle low, a cycle top, or breaks the previous all-time high.

Simplification. It simply lags Bitcoin by 3-6 months, with a dip when BTC makes a new ATH after a bear market.

The summary is that Bitcoin leads the way (again).

There are some important milestones along the way that can help with timing the market:

- Alts underperform for ~6 months after BTC bottoms.

- Then, alts start to outperform.

- Then, as BTC hits a new all-time high, alts briefly underperform, as BTC takes the attention (and money) away from alts.

- Then alts hugely outperform, until a few months after BTC tops out.

The Bitcoin all-time high should present an opportunity to rotate further down the risk spectrum into lower-cap altcoins.

Alts have already started to outperform.

4. DeFi leads alts.

This one’s a little more speculative. While the previous points are based on history repeating itself, this one has only happened once before – not enough to be sure of a pattern.

DeFi protocols typically hold a lot of other cryptocurrencies in their ‘TVL’ (Total Value Locked), whether it be for providing liquidity for swaps, or for borrowing/lending, or something else. TVL is one of the main metrics to assess the value of DeFi protocols. More TVL makes the protocols more valuable; because the liquidity is deeper (in $ terms).

When the value of the cryptocurrencies go up in $ terms, so does the TVL in $ terms, even with no actual growth of the number of coins locked. In that way, DeFi protocols grow without any growth in users.

If DeFi protocols also see modest growth in users, the TVL can go up even more as new coins come in. This is basically double growth. In this way, DeFi tokens are like leveraged cryptocurrencies.

Furthermore, as the rest of the market appreciates in value, people want to speculate more. And to do that, they need to use DeFi protocols to swap, leverage, or trade. As speculation increases, so will DeFi metrics.

One narrative I’m happy to bet on is that speculation will return. I want to own the protocols that profit from speculation: DEXs, perps/options protocols, borrowing and lending protocols, etc.

In the first half of the last cycle, DeFi tokens stole the spotlight. They showed astronomical growth. I think they’ll grow a lot in the first half of every cycle.

One particular area I’m looking at is onchain options. Options haven’t yet seen a lot of growth, but there’s no reason why they shouldn’t! They’re absolutely perfect for speculation. There are 4 reasons why options protocols could see huge growth:

First, options do well when volatility increases, and volatility will increase hugely in the bull market.

Second, options do well when other DeFi activity increases. Options are used in DeFi for hedging.

Third, options do well when speculation increases. Options are used to speculate, and could see their volumes increase drastically.

Fourth, onchain options are new. Most don’t have tokens yet. New things do better; there are fewer sellers, and a fresh narrative with most people finding themselves underexposed.

As for which options protocol, I have no idea.

5. NFTs won’t come back, yet.

Again, there’s only really one previous instance to base this off, so it’s more speculative.

The pattern throughout all my previous points has been that there is a spectrum of speculation which ramps up as the market goes up. Less speculative assets (like Bitcoin) pump first. Then more speculative assets (like DeFi, which has some present utility, but can also be speculative, and benefits from speculation), then finally ultra-speculative assets (like metaverse coins and utility-free JPEGs).

The reason is that there is so much more money sloshing around at the end of the cycle than the beginning. At the beginning, it’s a tight market where fundamentals matter. At the end, there’s plenty of excess money willing to bet on unlikely, speculative, or long-term bets where fundamentals don’t matter nearly as much as the idea.

NFTs are not dead, and I fully believe they will bounce back. But I don’t think they’re likely to take the spotlight in the first half of the bull market. That’s reserved for Bitcoin and DeFi.

I still think they’ll do ok – just not crazy, yet.

6. Airdrop season will be mad.

ZKSync. Eigenlayer. Lens. Farcaster. All have the potential to be the largest airdrops ever. All likely to airdrop in 2024, along with 100+ others.

Over the last 2 years, protocols like these have been building. They’ve gone from idea to prototype to release, and are now attracting users and scaling.

All that growth of 100+ projects is currently invisible and not affecting the wider market. But as soon as they launch their tokens, there will be billions and billions of value unlocked and injected into the market.

Tons of money will start flowing around. People who haven’t been in web3 or hunting airdrops will start getting FOMO. Numbers will go up, it will get crazy, and very loud, and probably quite annoying.

But through all the craziness is a fundamental truth: value that has been created over the last few years will get unlocked. All these protocols were putting it off because no-one wants to airdrop in a bear market. The floodgates will finally open and the markets will get flooded with money.

This happened last cycle, and it will happen again.

7. Layer 2s continue to grow.

The growth in Ethereum Layer 2s has been one of the big stories of 2023. They’ve been multiplying like rabbits, and attracting a ton of users and value.

Total Value Locked on all layer 2s since 2019. Source: l2beat.com

Simply extrapolating from the last 2 years, total TVL could reach ~$100B and total average TPS could reach 200. Again, this isn’t a very long-term pattern and extrapolation can be tricky, but I see no reason why it won’t continue.

It’s hard to measure ‘growth’ itself, and TVL/TPS are certainly flawed metrics for that. Perhaps I should also predict that there will be over 100 L2s by year end. Either way, L2s will grow in whatever sense that word means.

8. Something incredibly dumb takes a lot of focus.

Bull markets are so loud, so annoying, and so dumb. The things that take off are usually the dumbest possible. Speculation bids dumb stuff to ridiculous levels. The majority will happen after BTC’s ATH.

Dumb stuff works. Dogecoin is so dumb when you think about it, and yet it went up 30,000%. You had to be verging on insane to buy a Bored Ape, before Bored Apes were a thing (and before NFTs took off), but it would have made you rich. Bitcoin itself is kind of dumb – it’s an imaginary internet coin that doesn’t do anything – and it’s one of the best performing assets in the last decade. The principle that ‘dumb stuff works’ is not limited to crypto – fashion is so dumb. Pop music is always dumb. Football is very, very dumb. The dumbness of an idea is no indication of whether it’ll work; dumb stuff works.

Maybe it’s because people are dumb? But I love Taylor Swift’s repetitive melodies, and watching 11 men try to kick a ball between two goalposts, and I don’t think I’m dumb. Maybe instead, it’s that our understanding of the world is incomplete, and evaluating an idea based on an incomplete framework leads to a lot of successful anomalies looking like they don’t deserve to be there.

Either way, dumb stuff works, and it will keep working. I’m looking forward to observing the madness, from afar. I don’t think I have the balls to buy all the dumb stuff, and I’m not sure that’s a winning strategy, but perhaps I’ll have the fortitude to turn part of my brain off and not get too cynical.

Conclusion

I wrote all of these based on one core prediction: that history will repeat itself.

However, along the way, I’m sure there will be plenty of surprises. History doesn’t repeat itself exactly, but it does rhyme.

I might be wrong if I’ve not interpreted the patterns correctly, and the final few are certainly more open to interpretation. But the main principle is to identify the trend and trade with it. It’s not rocket science. I’ll be trying hard to not get scammed or phished or overtaken by greed, to not get emotional or tribal and miss the forest for the trees, and to just hop on to the big trends and enjoy the ride ✌️.

No responses yet